🚀 Why Founders Love SAFE Notes

Raising capital in the early days of a startup is tough. You don’t want to waste months negotiating valuations, dealing with legal fees, or giving up board seats too early. This is where SAFE notes shine.

✔ Fast & Simple – No valuation negotiations, no cap table updates until conversion.

✔ Founder-Friendly – No repayment obligations like a loan, no immediate dilution.

✔ Investor-Friendly – Converts into equity in the next priced round at a favorable rate.

SAFE notes are by far my favorite instrument for raising early-stage capital. However, everything has a flip side—and if you don’t understand how they work, they can cost you much more than expected when they convert.

So, what should you consider before signing a SAFE?

🔍 How SAFE Notes Work

A SAFE (Simple Agreement for Future Equity) is an agreement where an investor provides capital now in exchange for the right to convert into equity later when the startup raises a priced round (e.g., Seed, Series A).

When a SAFE converts, the number of shares the investor receives depends on either:

1️⃣ A Valuation Cap – The max valuation at which their investment converts into shares.

2️⃣ A Discount Rate – A percentage discount off the next round’s price per share.

If a priced round happens at:

Above the Valuation Cap → SAFE converts at the Cap.

Below or Equal to the Valuation Cap → SAFE converts at the Discount.

Now, let’s apply this to a real-world example.

📊 Example: SAFE Note Conversion in a Priced Round

A startup raises $1M on a SAFE with:

Valuation Cap: $10M

Discount: 20%

Next round: Raising new capital in exchange for 20% of the company

We compare two cases:

1️⃣ A Higher Valuation ($20M) → SAFE converts at Valuation Cap (because $20M - 20% > $10M cap)

2️⃣ A Lower Valuation ($10M) → SAFE converts at a Discounted Price (because $10M - 20% < $10M cap)

Formula for SAFE Conversion Price Per Share:

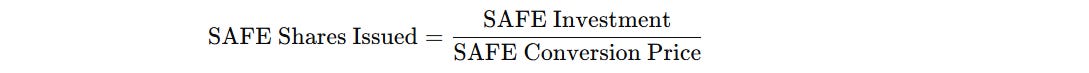

Formula for SAFE Shares Issued:

Let’s go through examples

🟢 Scenario 1: Raising at a $20M Valuation

Since the $20M (-20%) valuation is higher than the SAFE’s $10M cap, the SAFE converts at the cap ($10M).

Step 1: SAFE Conversion Price Per Share

Since the $20M valuation is higher than the SAFE’s $10M cap, the SAFE converts at the cap ($10M) instead of taking the discount.

Step 1: SAFE Conversion Price Per Share

Since SAFE holders are converting at the $10M valuation cap, they get a conversion price of:

This means SAFE holders are effectively paying $0.50 per share, while new investors are paying $1 per share since they are investing at a $20M valuation.

Step 2: SAFE Shares Issued

Step 3: New Investors’ Shares

New investors are buying 20% of the company at a $20M valuation:

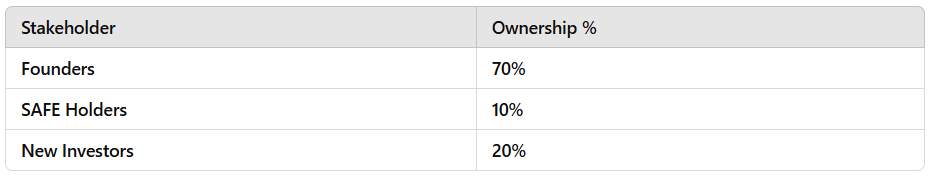

Final Ownership Breakdown

✅ SAFE diluted the founders, but they still retain 70% of the company.

🔴 Scenario 2: Raising at a $10M Valuation

Since the $10M valuation is equal to the SAFE’s cap, the SAFE now converts at the discount instead of the cap.

Step 1: SAFE Conversion Price Per Share

New investors are paying $10M for 20% of the company, so their price per share is:

SAFE holders, however, get a 20% discount on this price:

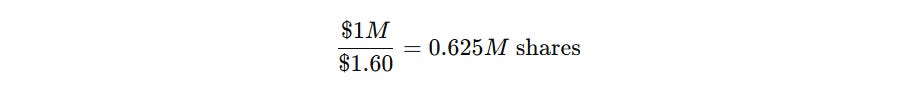

Step 2: SAFE Shares Issued

Step 3: New Investors’ Shares

New investors are still buying 20% of the company:

Final Ownership Breakdown

❌ Founders expected to keep 70%, but now only own 67.5%

As valuation at the priced round goes down, the founders share tanks after the conversion

🔑 How to Avoid the SAFE Dilution Trap

✅ Model Dilution Before Raising a SAFE

Run different valuation scenarios ($20M vs. $10M) to see the dilution impact.

✅ Negotiate the Discount & Cap Carefully

A high discount (e.g., 20%) can massively increase SAFE dilution if the valuation is low.

✅ Consider a Post-Money SAFE Instead

Post-money SAFEs fix investor ownership, making dilution more predictable.

🚨 Before Raising a SAFE, Ask These Questions:

✔️ What happens if I can’t raise at a higher valuation in the next round?

✔️ How much will I actually own post-conversion at different valuations?

✔️ Would it be better to raise on a priced round early instead of a SAFE?

💬 Have you ever been surprised by SAFE dilution in a later round? Share your experience below! 👇